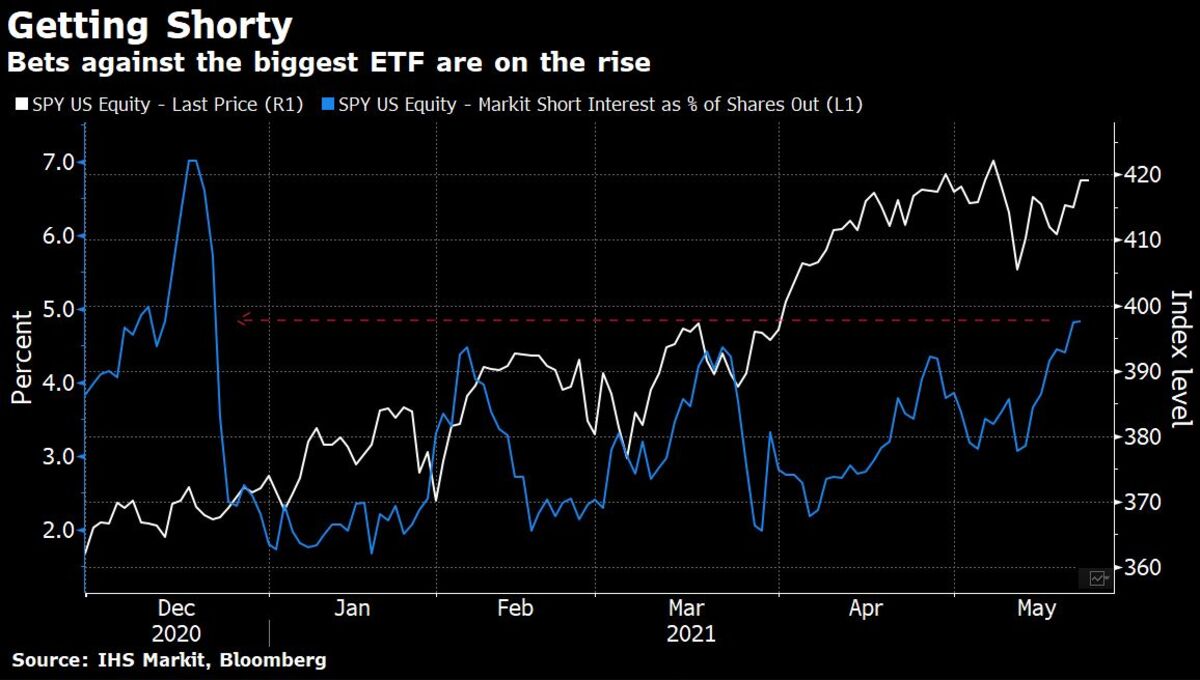

Jesse Felder on Twitter: "Short interest on the S&P 500 ETF is near the lowest since early 2007 https://t.co/2frENCtfqG https://t.co/k05Nd9zq89" / Twitter

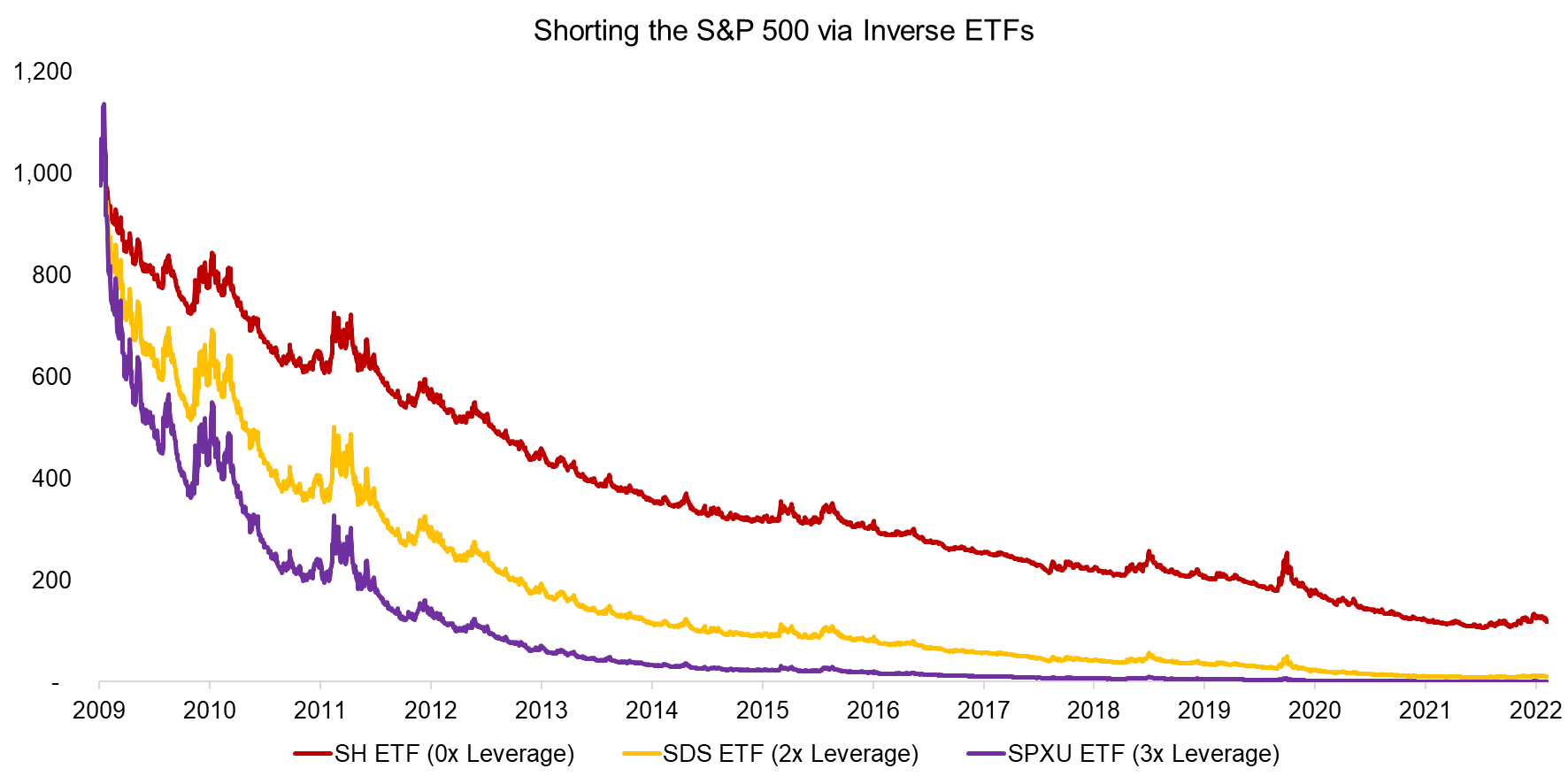

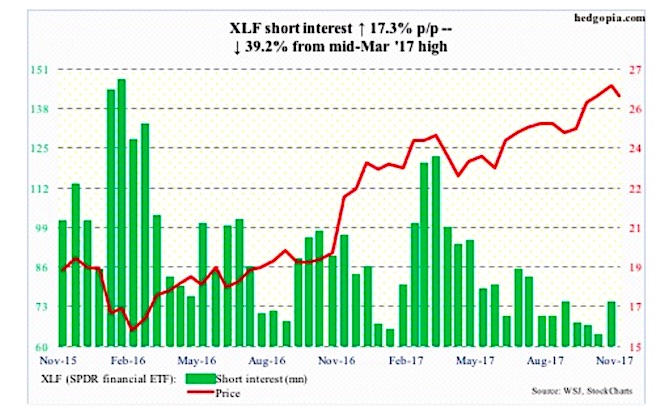

An Active Short-Only ETF - Focus On Bad Stocks, Not The Whole Market (NYSEARCA:HDGE) | Seeking Alpha

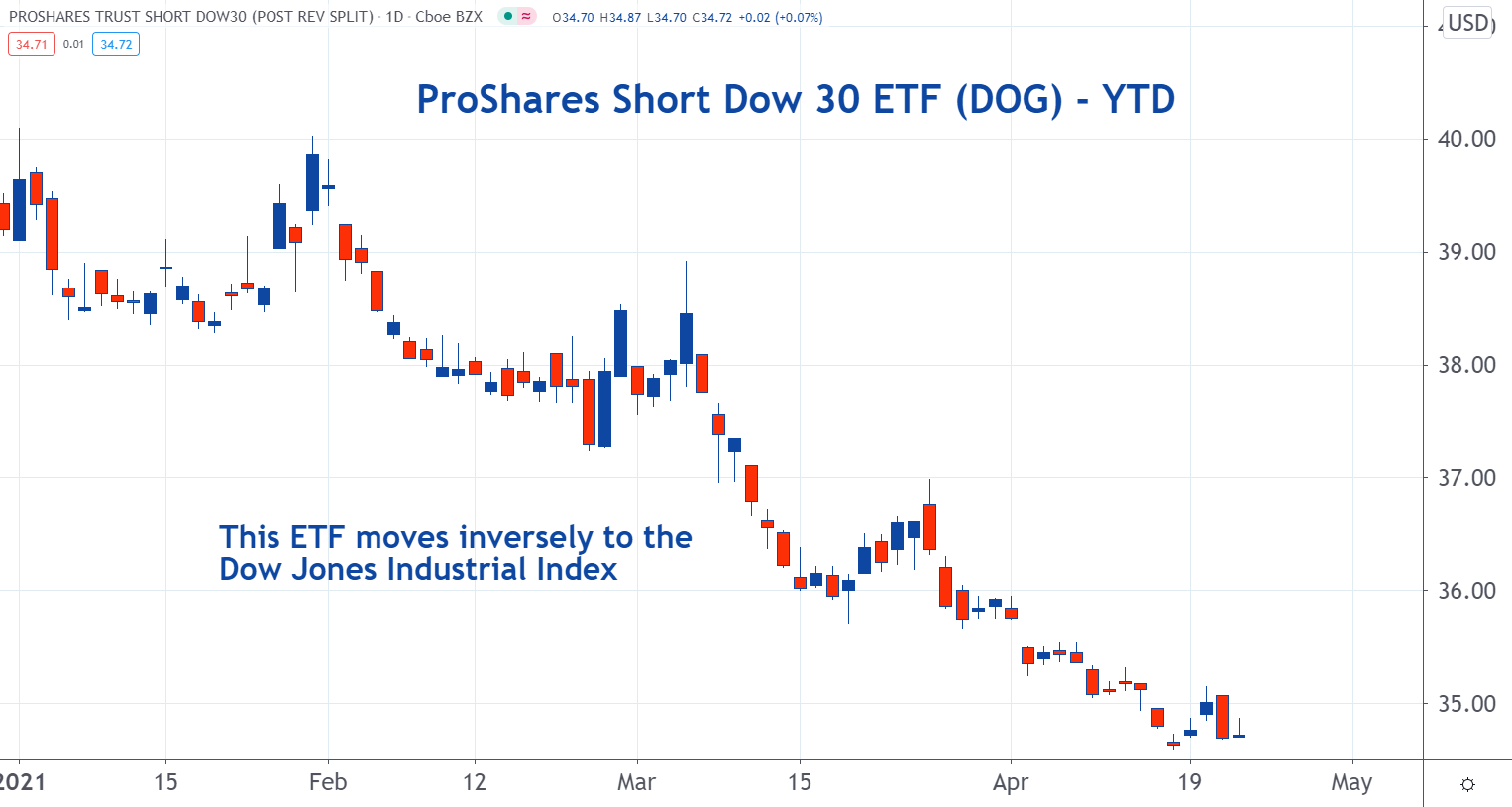

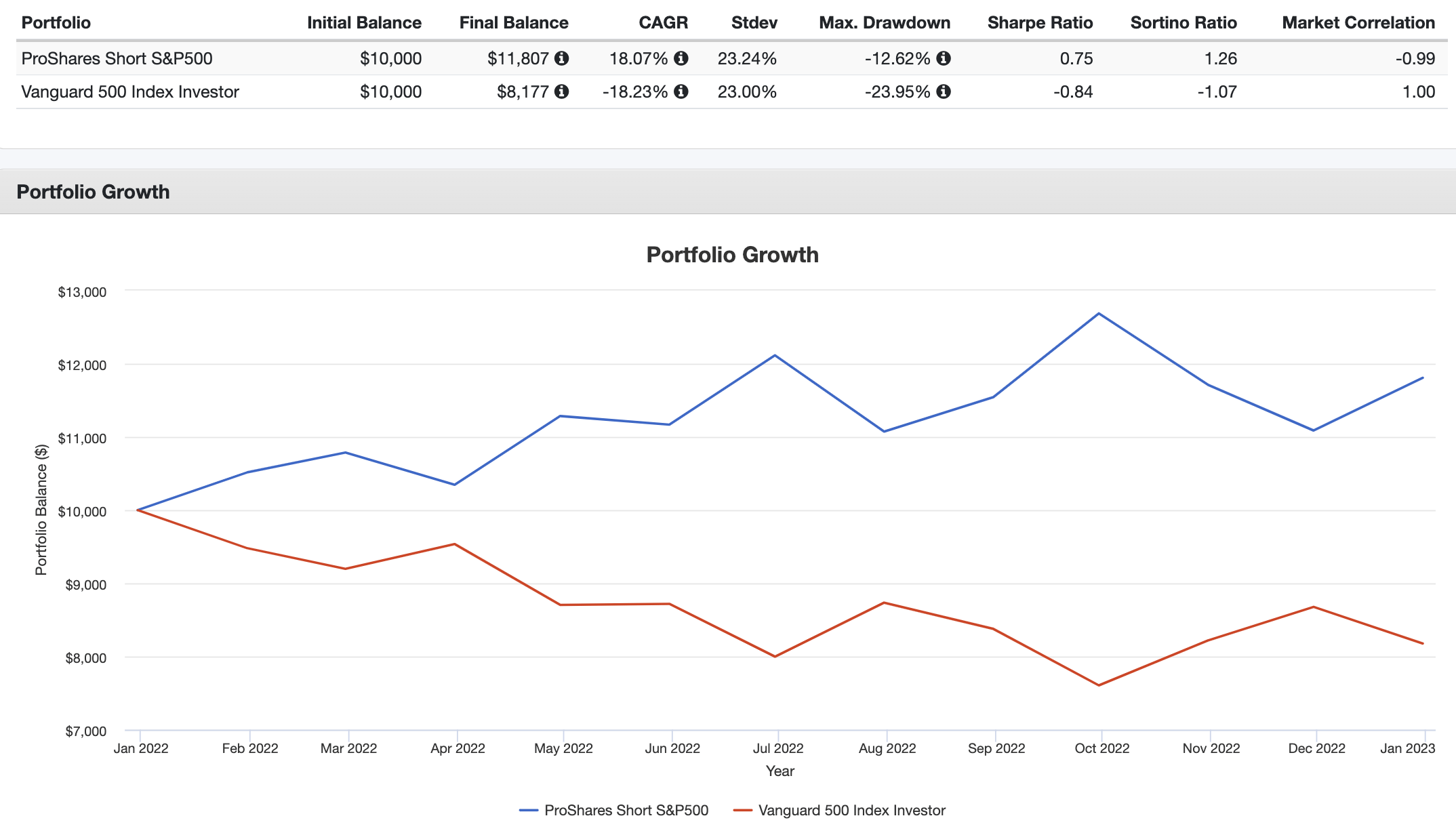

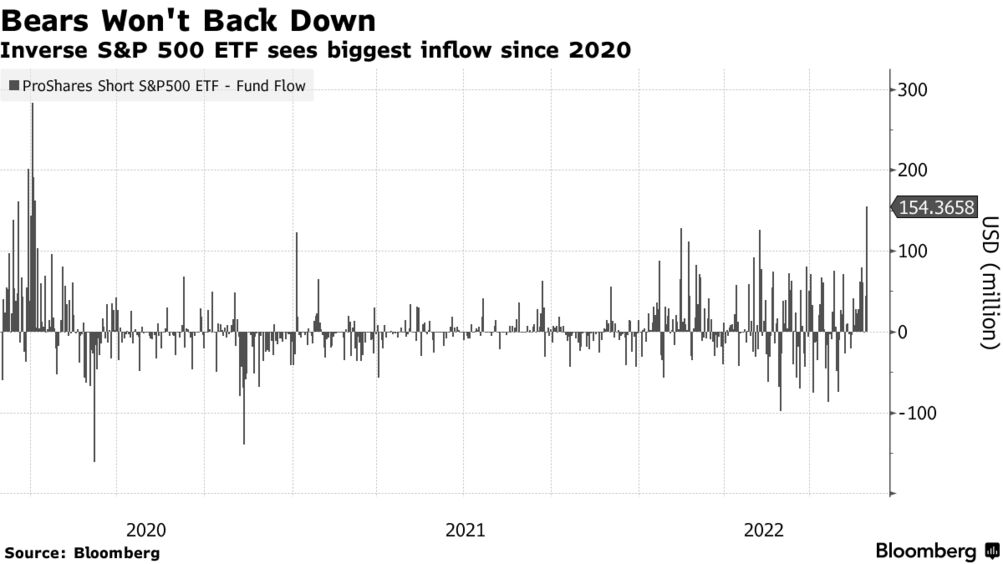

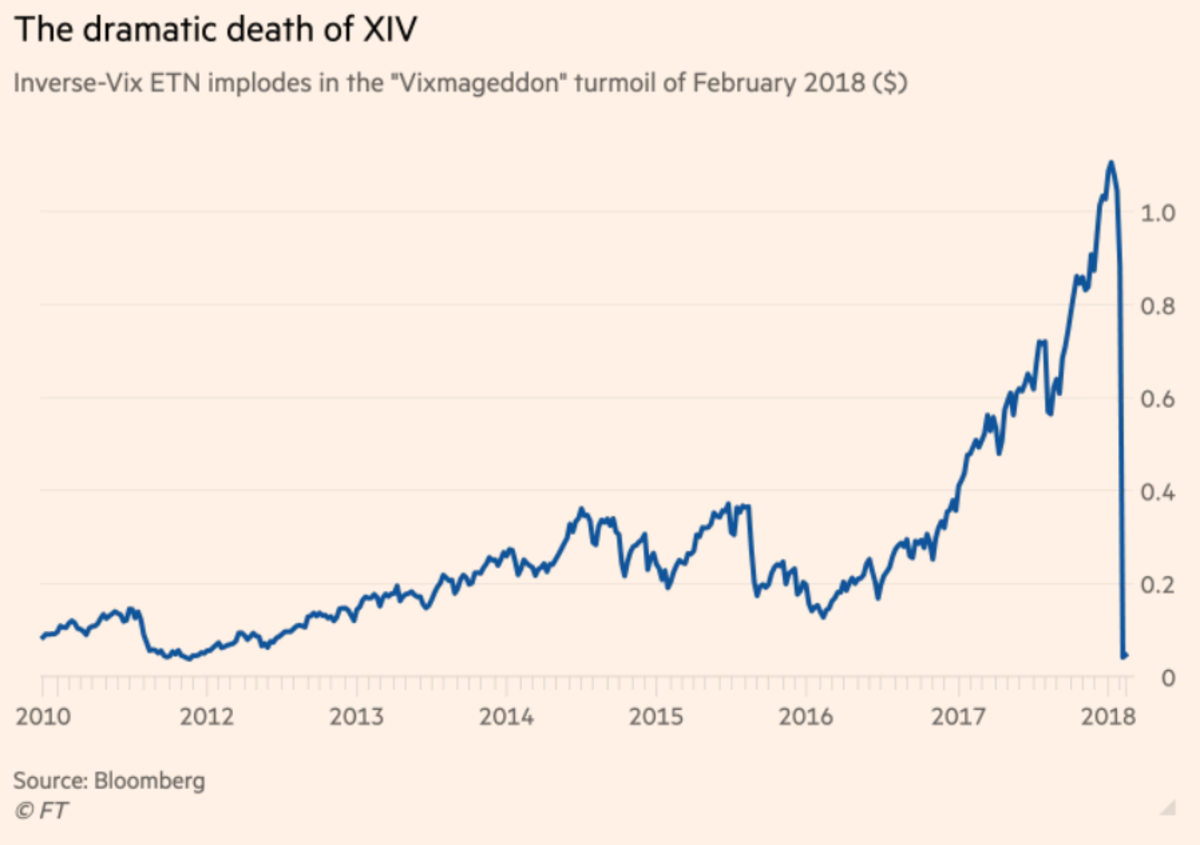

Do You Have A Systematic Process For Managing Inverse ETFs? - Erlanger Research - Commentaries - Advisor Perspectives

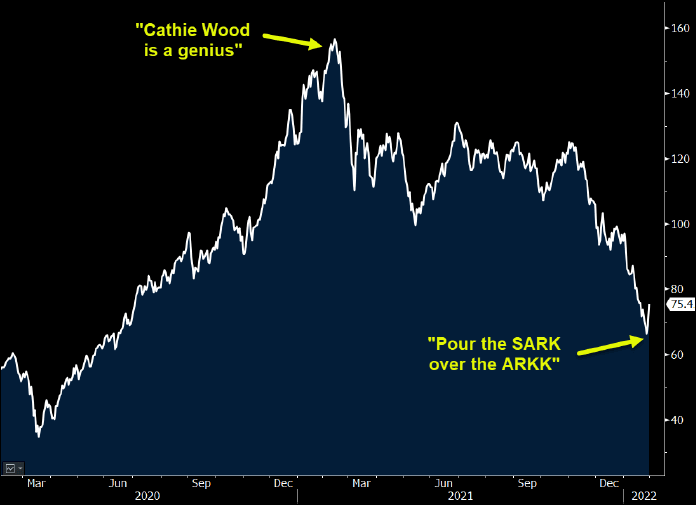

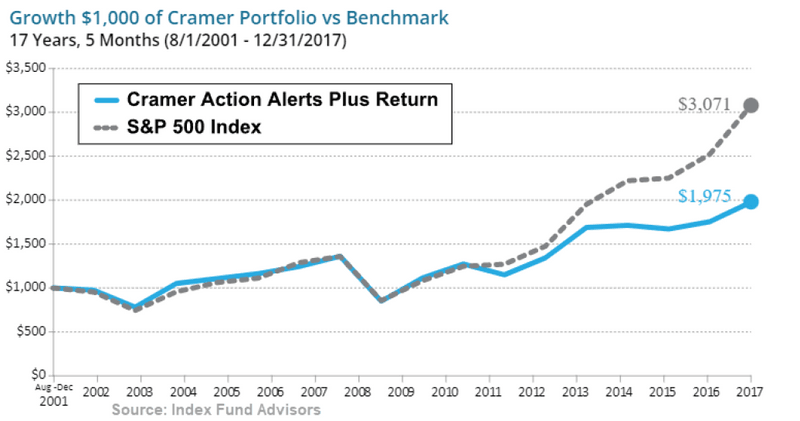

Time may be ripe for an inverse Jim Cramer ETF after ARKK call | Insights | Bloomberg Professional Services